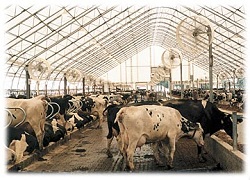

How Factoring Can Help Agriculture & Dairy Businesses Address Their Cash Flow Challenge

When used as a long-term solution for financing, factoring can prove to be beneficial to those engaged in the Agriculture & Dairy sectors, a fact that is often overlooked because of the mistaken identification of factoring for purchasing overdue receivables or resolving occasional one-off problems of liquidity.

When used as a long-term solution for financing, factoring can prove to be beneficial to those engaged in the Agriculture & Dairy sectors, a fact that is often overlooked because of the mistaken identification of factoring for purchasing overdue receivables or resolving occasional one-off problems of liquidity.

Financial resources are always inevitable in business procedures. From growing crops, harvesting, packing, and delivering fresh farm produce to supermarkets, grocery stores, commercial establishments, schools, and government programs or projects, there is a mandatory need for cash flow.

What is Factoring?

Factoring in so many words simply means purchase of invoices and/or outstanding or long receivables and the assumption of the particular risks which are directly associated with them.

In the simplest of terms, this is how it works: in a general factoring arrangement there is a client that sells, delivers a service or product, and generates his or her invoice.

The client has a funding source who collects on the invoice by paying the client�s invoice at face value minus the discount of, usually, between two and six percent. The funding source immediately pats between 75% and 85% of said face value and subsequently forwards the balance, minus the discount, when the client�s customer pays him or her.

How Factoring Works in the Simplest of Terms:

The funding source extends the credit to the client�s customers and not to the client him- or herself. A company that has customers who are credit-worthy may, in fact, engage in factoring even if it is unable to qualify for any loan. The funding source�s main concern is actually more on the ability to pay of the client�s customers than in the client�s financial status.

The constantly evolving Agricultural & Dairy industries require frequent adjustments to meet the challenge of changing needs and concerns of farmers and growers, packers and shippers, deliverers and suppliers. Problems in the cash flow of any business tend to interrupt operations such as those that involve:

- � Paying workers on time.

- � Purchasing new tools, equipment, and supplies.

- � Paying down other payables.

- � Expanding operations.

Factoring Qualifications

These are some requirements which have to be met by the client in order to qualify for factoring:

- � Client must transact � sell or deliver a product or service � with businesses that are deemed �credit worthy� or companies with commercial accounts.

- � Client has not pledged his or her accounts receivables as collateral.

- � Client�s business must have a minimum volume or production of $100,000 monthly.

- � Client must have his or her updated financial statements and updated reports on receivables aging.

- � Client must keep in mind that the rates for agricultural factoring will be subject to qualities of account debtor and volume on a monthly basis.

Choose a Reputable Factoring Company

Businesses are built on trust and this condition must exist for client and funding source when factoring has been decided upon. When a client has a reputable factoring company that is trustworthy, working capital, funding business expansion, and improving cash flow will all be worry-free.

Consider NeeBo Capital for Agricultural & Dairy factoring, a company that is not only trustworthy but highly dependable with creating highly flexible funding solutions. Unlike most banks and lenders that are asset-based, NeeBo Capital will facilitate cash flow solutions without making the client wait for a long time.

Don�t wait while your competitors factor their accounts receivable. Take advantage of low factoring rates in the Agriculture & Dairy farming industry Today!

Why Choose Us?

Rates at 0.59% - 1.5% for 30 days

Quick Link to Financial Resources:

| Purchase Order Financing | Accounts Receivable Financing | Asset Based Lending Options |

General Articles about Accounts Receivable Financing and Factoring:

» 08/01/2012 Debt Financing or Off Balance Sheet Financing?

» 11/30/2012 Utilizing Factoring as a Alternative to Traditional bank Credit

» 07/22/2012 Increase Your Business Lines Of Credit By Factoring Accounts Receivables

» 09/15/2011 What to know when selecting a Factoring Company